uber eats tax calculator nz

You simply take out 153 percent of your income and pay it towards this tax. For example if your taxable income after deductions is.

If youre providing your time.

. Uber eats tax calculator nz. Expenses you incur while providing ride-sharing services are deductible. Using our Uber driver tax calculator is easy.

You can currently work as an Uber Eats delivery driver in the following cities. The tax year runs from 6th April to 5th April unlike the financial year which runs from 1st January to 31st December. Order food online or in the Uber Eats app and support local restaurants.

Get contactless delivery for restaurant takeaway groceries and more. This calculator will help you work out what money youll owe HMRC in taxes. The average number of hours you drive per week.

All you need is the following information. Effective March 1 2021. In New Zealand you may need to register for GST if your turnover exceeds or is expected to exceed 60000 in a 12 month period.

Average income for Uber drivers will vary on the circumstances of each driver but an average income of 25 to 35 per hour after Uber takes its cut is about average. Find the best restaurants that deliver. Your average number of rides.

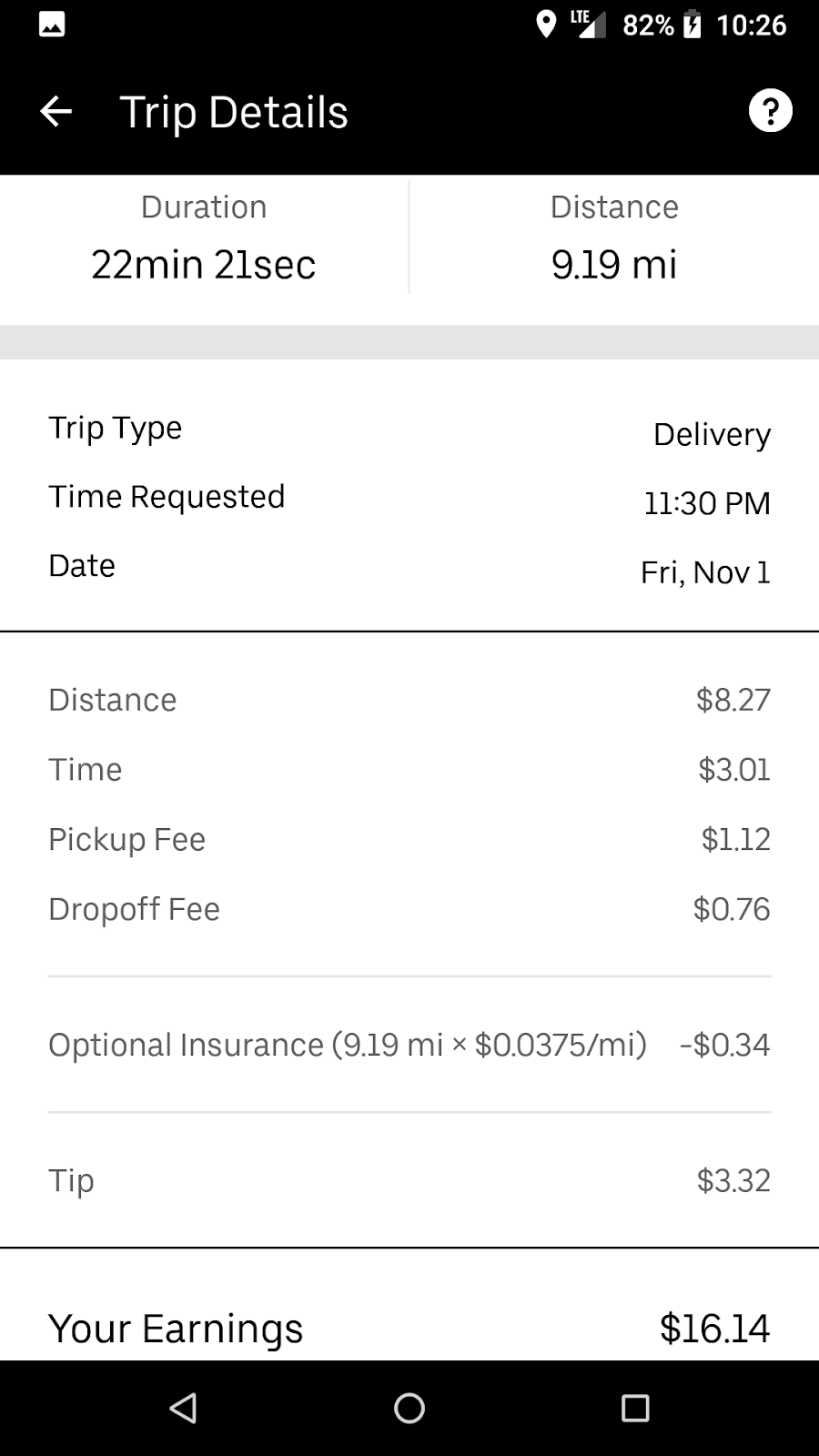

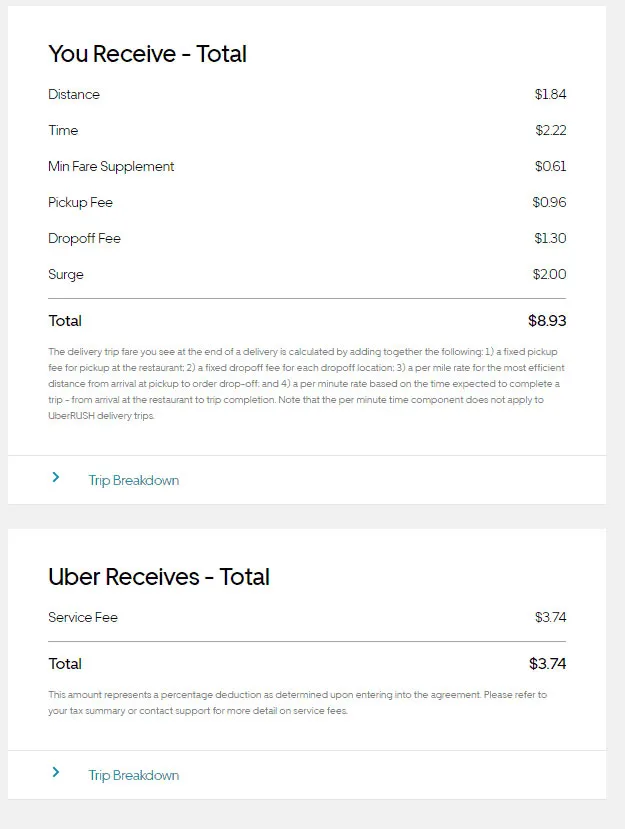

This Uber Eats tax calculator focuses on Uber Eats earnings. According to financial accounts filed with the New Zealand Companies office Uber declared gross revenues of 1061018 in New Zealand in 2014 but paid just 9397 in income. Fees paid to you when you provide personal services are taxable income.

For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income Friday. However much of this is similar for other gigs like. You may also have to pay goods and services tax GST.

Expenses can include costs related to maintaining or operating assets such as a vehicle or mobile device. For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income tax rate goes. Uber Tax is a service for Uber drivers seeking specialist advice a stress-free tax return and the peace of mind that their Inland Revenue tax obligations are taken care of.

Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. Heres the thing. This includes revenue you make on Uber rides Uber Eats and any other sources of.

In relation to delivering for Uber Eats turnover may. The self-employment tax is very easy to calculate. Being a food delivery driver for other gigs like.

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Uber Eats Riders Earning As Little As 5 For Deliveries Crossing Multiple Nsw Suburbs Uber The Guardian

Uber Eats Now Allowing Drivers To Deliver In Other States

How Does Uber Eats Make Money Uber Eats Business Model Feedough

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Tax Calculator And Other Useful Calculators And Tools Kiwitax

Uber Tax Information Essential Tax Forms Documents

How To Pay Taxes On My Uber Eats Earnings Quora

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber For Business Sap Concur App Center

Why Uber Eats Is A Necessary Evil By Joelle Parenteau Medium

Ubereats Tax Return Deductions Uber Drivers Forum

The Uber Lyft Driver S Guide To Taxes Bench Accounting

How To Do Your Taxes For Uber Eats Partners In Australia Youtube

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income